SimFinance

A downloadable mod

What It Is

This mod started out as a patron asking me to create financial reversals of fortunes for sims a la calamitous sims but with financial consequences because we agree it's too easy to accumulate wealth in the game. But then I wanted to have ways for them to mitigate those disasters. Maybe they needed roof repairs due to some unexpected storm damage. Could maybe home insurance cover a portion of that after their deductible? The answer to all of that was the creation of this mod and of SimFinancial Credit Union.

This mod is somewhat modular so if you only want one part of the mod you can pick and choose what you'd like in terms of including Financial Events, Insurance, or Loans. The base mod is required for all Credit Union services (including loans, investments, credit cards, and insurance) therefore Credit Scores, Credit Union accounts, and Income Taxes are part of the base mod. You do not have to need to keep a large amount of funds in the account, but being a member of the SimFinancial Credit Union is required to utilize its services.

The credit union aspect was created and is intended to be a simple banking experience to facilitate other aspects of the mod. It can be used independently of those features, however, and that's why Loans, Financial Events, and Insurance are separated but it is not the major focus of this mod since there are other more comprehensive mods for that. But I needed somewhere that would house those typical banking services and thus the credit union was created and there's no point in having one without bank accounts.

Core Mod Features

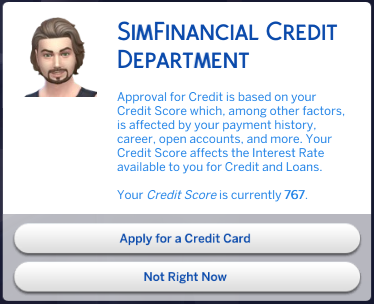

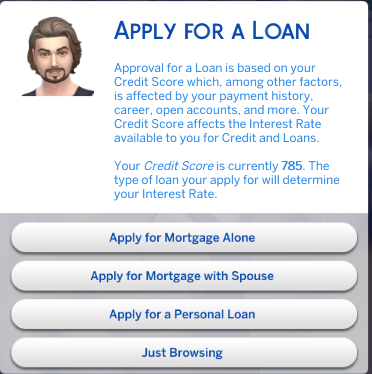

Credit Scores

Every Sims is assigned a credit score. The Credit Score is based upon factors such as income, career levels, marital status, open accounts, if bills are paid, late payments, defaulted or charged off accounts, on time payments, cash, property values, and more. Your Credit Score is not static. If your Sims lose their job or opens a new account or fails to make a payment a the credit score is affected. Every time they apply for a new credit card, loan, or insurance, the credit score is run and it can vary.

Income Taxes

No longer will sims not pay income taxes! Your sims will be taxed biweekly based on the personal income levels based on a week's average salary of their chosen profession for all regular game careers. For freelance careers and gig workers and custom careers those income levels are based on the average of similar regular careers. Taxes are higher for sims in higher career levels and with more lucrative and prestigious professions and lower for part time workers and lower paying jobs. If your sim is married, they will be taxed jointly with slightly favorable tax rates. There is also a slight tax break for Sims with dependents.

Bankruptcy

Sims who have fallen on hard financial times can petition for Bankruptcy. They can File Bankruptcy via phone under the Household menu or General Pie menu. Once they have filed the claim, they will be directed to attend Bankruptcy Court where a judge will hear their case. If their claim is denied, they will have to keep paying their debts. If their claim is accepted, their debts will be discharged (student loan debt the exception), some of their assets might be repossessed, their credit score will be affected, and their household funds and bank accounts will be liquidated up to the full amount owed on any and all debts.

Credit Union Accounts

Opening an Account

The mod can be accessed for the first time via the phone under the Household menu or General Pie menu as "Open a SimFinancial Credit Union Account." Once an account has been opened the menu can be accessed via the Household phone menu or General Pie menus or by clicking on your Sim.

Being able to access the mod via the Sim is helpful in case your phone has been shut off or broken (see Unexpected Expenses) and you need a quick credit card cash advance or a loan to get it back up a running.

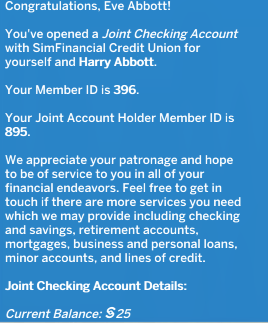

Checking and Savings Accounts

Your sims will need to open a Joint or Personal Checking with SimFinancial Credit Union in order to access savings accounts, retirement accounts, insurance, credit cards, or investment options through the Credit Union. Opening an Account requires a 25 dollar deposit. Sims can choose to have automated transfers from other accounts to their checking accounts and from their daily paychecks into their checking accounts.

Joint Accounts are between two sims in a relationship whether dating, engaged, or married. If sims with a Joint Checking Account break up or divorce then their Joint Checking and Savings accounts are equally dispersed into separate Personal Checking and Savings Accounts.

You do not need to place large sums in these accounts but they are required to be opened. With their Checking Account they have access to all other services. When a sim with an open account dies, their account contents are transferred either to their remaining spouse's accounts, if available, or to the household funds, if not.

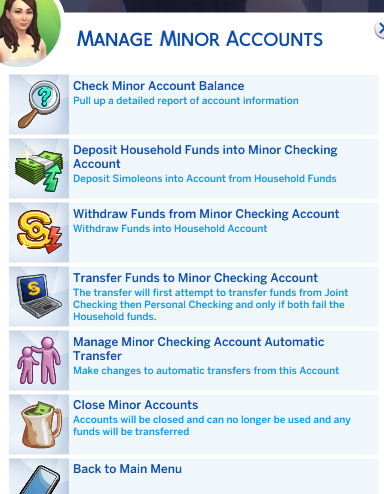

Minor Accounts

Once your sim open an account, they are also able to open Minor Checking and Savings Accounts for their children, infant and up. Both parents have access to minor accounts. They can setup automatic deposits from the household funds to their children's savings accounts. They can also setup automatic deposits into the Minor Checking account as a weekly allowance. When Teens age up their Minor Accounts are transferred into Personal Checking and Savings accounts.

Business Account

If a Sim owns a business (small business or retail or landlord) they can open a Business Account. To transfer funds from your Sim's small business/retail business/vet lot to the Business Account they must be physically on the lot. If they want to transfer funds from their Business Account to their small business/retail/vet funds they must also be on the business' lot and if a small business, it must be opened. These are game limitations. Transfers between the Business Account and other owned accounts can happen on any lot.

Retirement Accounts

Your Sims can open a separate Retirement Savings Account. This is available for Young Adults to Elders. This is an interest bearing account. The earlier you open a Retirement Account in life the better your interest rate. You can setup automatic deposits to your Retirement Account to facilitate easier saving. When your sim retires or if they are already retired, they can access the funds in the account.

Trust Funds

Adult Sims and older can set up Trust Funds for minor sims (infant through teen) in their family. The minimum amount to fund a Trust Fund is $1,000. When the minor sim reaches young adulthood, they will be able to access the funds available in their Trust Fund, which can be transferred to their bank account or household funds, if they don't have a bank account. Trust Funds are a service currently only available through a Financial Advisor.

Credit Union Services

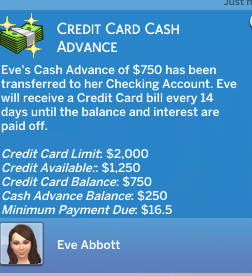

Credit Cards

Credit Cards are very simple. You can open one, get a credit credit card, and have a credit limit. The Credit Card simply facilitates the borrowing of some fast, smaller amounts of cash. You can get a cash advance from your credit card which has a daily cash advance limit. This will reset up to your credit limit. Then you will be billed every two weeks for your credit card balance. The payment will be taken from either your Personal or Joint Checking. If you miss payments you will be charged late fees. If after three missed payments you still have not paid your past due balance your account will be charged off. You can choose to pay the balance at any time.

Donor Advised Funds

Sims can setup Donor Advised Funds through a Financial Advisor to direct their philanthropic efforts. A Donor Advised Fund requires a minimum of $1,000 to open. Sims can direct their charitable grants from their DAF through their Financial Advisor to over 10 different Charitable Organizations and Causes. Charitable donations will offer Sims a modest tax break on their income taxes.

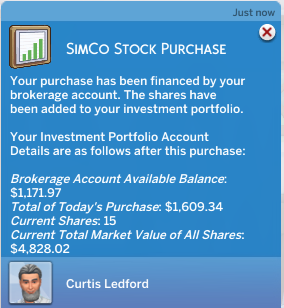

Investment Portfolio

Sims can now invest in the fickle stock market. Open a Brokerage Account and start buying and selling shares of SimCo stock. The current market value of the shares changes based on current market conditions at the time of the sale or purchase. While they do not fluctuate daily, market conditions shift over time and what you value of your shares can remain stable, go down, or go up. Keep an eye on the markets for the best time to sell and make a profit! Funds from your Brokerage Account can be transferred to your Checking Account or Household funds. But in order to buy or sell shares your Brokerage Account must be funded.

Financial Advisor

Sims can utilize Financial Advisors who will help Sims with the following services: management of their investment portfolio including suggestions of when to sell and when to buy, setting up and managing trust funds, as well as setting up and managing Donor Advised Funds including suggesting charities to direct grants to. Trust Funds and Donor Advised Funds are only services available through a Financial Advisor.

Modular Components

Financial Events

Your sims can have the chance to have an unexpected expense.

Expansion Pack Notes

If you have an Expansion pack that allows for a practical consequence it will occur. For instance, if you have Eco Living and there's a water leak, your water heater can be broken or if you have For Rent, a mold infestation can produce actual mold.

Financial Event Types and Consequences

Positive Financial Events

They can have a smaller, less common chance of inheriting some money, settlement money from a class action consumer lawsuit, a bonus at work, a tax rebate, and receiving cash from relatives as presents during life events (aging up, getting married, etc).

Negative Financial Events

Some possible negative financial events or unexpected expenses can include (but are not limited to so prepare for a few surprises):

- Your landlord deciding to institute pet rent

- An electrical outage causing you to lose power until you pay the electrician's bill

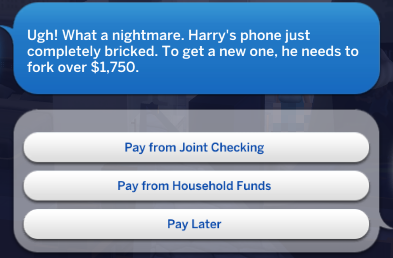

- Your phone breaking suddenly so that you are unable to use your phone

- A sudden spawning of mold around the house that requires fumigation. Pay to get it removed because it can't be removed until you do- not even by magic!

- Moving expenses when moving in and out of your sim's homes

- Pest Infestation with pests crawling around. You can't even stomp on them!

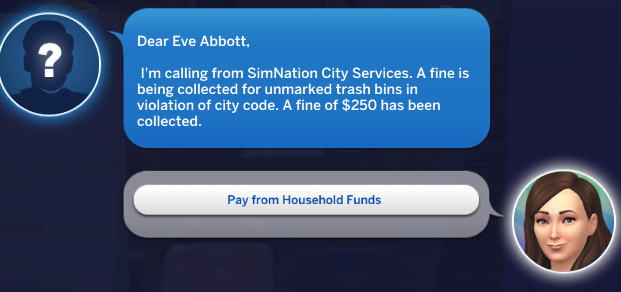

- Speeding or Parking tickets

- Engine Failure

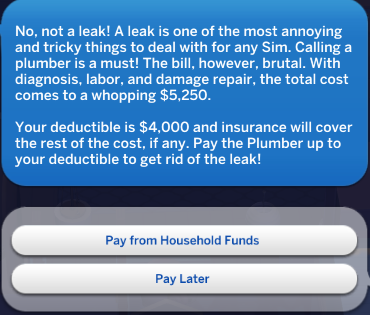

- Water Leak with water everywhere, plumbing fixtures broken, and water heater broken until the plumber is paid

- A random unpaid vet bill from months ago you forgot to pay

- A trip to urgent care that resulted in an unpaid medical bill

- The HOA charging a fine for a supposed association violation

and more!

Each financial event will cost your sim an amount from a small fine of maybe $250 to fairly substantial and varied amounts of simoleons up to $25,000.

You can choose to pay at the time you're notified of the issue to make it go away, pay later via the phone under the Household menu, or if your phone is unavailable due to the financial event (i.e. lost power or broken phone), by clicking on your Sim.

Mitigation Options

To mitigate some of these financial issues sims can buy insurance and/or take out a loan to cover the expenses. See below.

Insurance

Sims can purchase insurance to help cover some of the costs of those unexpected financial events.

Types of Insurance

Sims can purchase the following types of insurance:

Auto Insurance

Some financial events are travel/vehicle related. Integrated with SimNation Travel.

Homeowner's Insurance

Sim must own a residential, tiny residential, or haunted residential lot

Life Insurance

This is a separate policy from Golden Years

Medical Insurance

This is only available to Sims who have opted out of HCR insurance options or who do not have Healthcare Redux installed

Renter's Insurance

Sims cannot own a residential lot so an apartment or residential rental tenant

Pet Insurance Rider

For sims with cats and dogs who have Renter's or Homeowner's insurance you can purchase a Pet Insurance Rider to cover pet vet expenses from both the mod and actual visits to the Vet lot

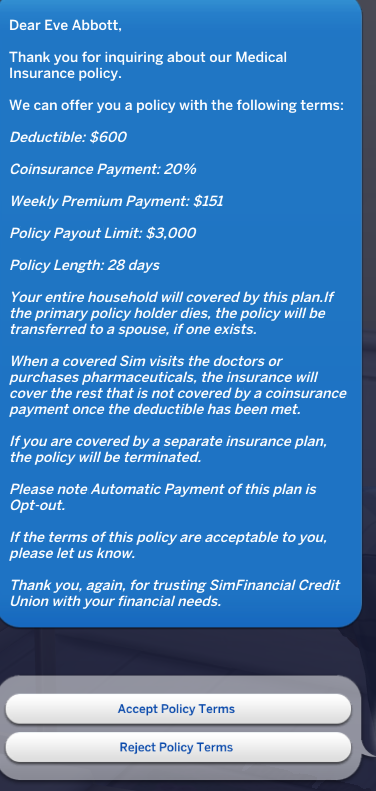

Insurance Quotes

To get started, the Sim has to request an insurance quote. An insurance agent will get back to them with the terms of the insurance policy they qualify for based on the credit score, their risk factors (for instance, for medical insurance if they have preexisting conditions, life insurance the age they're applying at, for auto insurance the type of vehicle they're insuring, and for home/renter the type of dwelling they live in and the property values) and the type of insurance they requested. Sims can either accept the insurance policy terms and start their insurance or reject the policy terms. They can apply again but may not get the same terms.

Each insurance has a policy limit, premiums that must be paid weekly, and a deductible to be met before insurance pays (excluding Life). A sim's Credit Score as well as the type of insurance (Basic, Standard, Premium) determines the policy's limit, premiums, and deductible.

How Insurance Works

Life and Auto Insurance are only apply to the Sim who opened the insurance. Homeowners, Renters, and Medical Insurance applies to the entire household. However, only the Primary policyholder (the sim who opened the account) can make policy changes. When the Primary policyholder dies, their spouse, if one exists, will be designated the Primary. Otherwise, if there is no spouse the insurance policy will be terminated for all others in the household and another adult will have to open a new policy of their own.

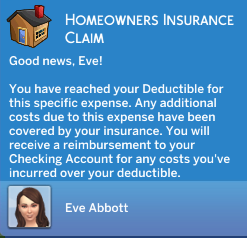

Property Insurance

For property insurance (Auto, Homeowners, Rental) when your sim has an expense covered under their policy, they will be notified if insurance has covered a portion of their cost. So if a sink breaks and the sim wishes to repair or replace that sink, if the cost to do so is more than their deductible than insurance will cover the rest and the sim will only need to pay for the portion not met by the deductible. The deductible does not accumulate. Each covered expenses is calculated individually to see if it meets the deductible. For instance if you repair 7 sinks they are seen as 7 separate expenses incurred and 7 separate times your sim would need to meet their deductible before insurance kicked in.

Medical Insurance

For Medical Insurance, this is different. Your sim will accumulate expenses up to their total deductible. So if a doctor visit is 20 dollars then that counts towards a larger deductible as opposed to their needing to meet the deductible each instance. Once your sim reaches their total deductible for Medical Insurance, they will then only be expected to pay a 20% coinsurance for 10 days. After 10 days, their total deductible resets and they will have to accumulate a total expenses equal to or exceeding their deductible in order for the deductible grace period to restart.

Life Insurance

Life Insurance policy limit is the maximum payout amount their beneficiaries can receive. A sim's spouse is automatically made the default beneficiary but this can be changed at any time. They can name up to four different beneficiaries of the life insurance policy. The Life Insurance policy earns interest as they pay premiums over time. When the Life Insurance policyholder dies, the policy will kick in and beneficiaries will be notified they can submit a claim to receive those death benefits. The inheritance is divided equally amongst beneficiaries.

Billing and Policy Renewal

The policy lasts for 28 days and autorenews. When the policy autorenews, the total deductible for Medical Insurance resets, the policy utilization resets, and any late payments from the previous iteration of the policy are reset.

Insurance Premiums are due weekly. If a Sim misses a payment they are charged a late fee and the past due amount is added to the amount of the next bill. After 2 missed payments, the insurance policy lapses and no expenses will be covered until the account is made current. After 3 missed payments, the insurance policy is cancelled.

Loans

Sims can apply for three different types of loans.

Types of Loans

Business Loans

Can be opened by Business owners

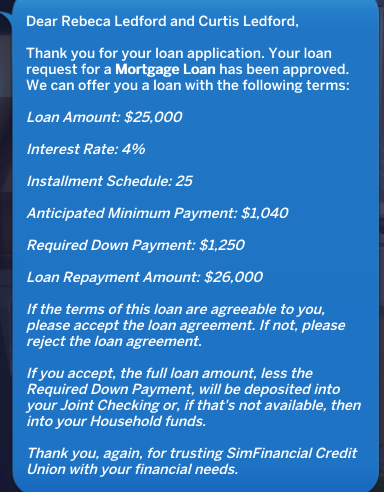

Mortgage Loans

Can be opened by all adult Sims. They can be applied for separately or with a spouse. The credit score of both spouses will determine the loan terms.

Personal Loans

Can be opened by all adult Sims.

Loan Applications

Personal Loans have slightly higher interest rates and smaller available loan amounts. Business and Mortgage loans have slightly average to lower interest rates and large available loan amounts.

You can choose your desired loan amount and a loan officer will inform you if your loan has been denied or approved and the terms under which it is approved such as interest rate, minimum payment, and installments. For mortgages, your sim's are required to make a downpayment. You can reject the loan terms or accept them. The funds will be distributed into your sim's checking accounts.

How Loans Work

Payments will be billed on a weekly basis for the duration of the loan's installments. Missed payments will receive late fees. After 2 missed payments, the loans will be placed in Delinquent status. After 3 missed payments, the loans will be considered Defaulted and closed. Your sim will have a harder time getting a loan in the future if Defaults exist on their credit history.

| Status | In development |

| Category | Game mod |

| Rating | Rated 5.0 out of 5 stars (1 total ratings) |

| Author | adeepindigo |

Download

Install instructions

Requires Lot51 Core Library